Photo Amax

The CBD space has largely stalled over the past two years due to regulatory inaction. Charlotte’s Web Holdings (OTCQX:CWBHF) (‘CWH’), a once promising stock, has turned into a disaster with years of no growth. My investment thesis is bullish on the stock’s valuation, but CWH is unlikely to rebound much until the regulatory environment changes.

going nowhere fast

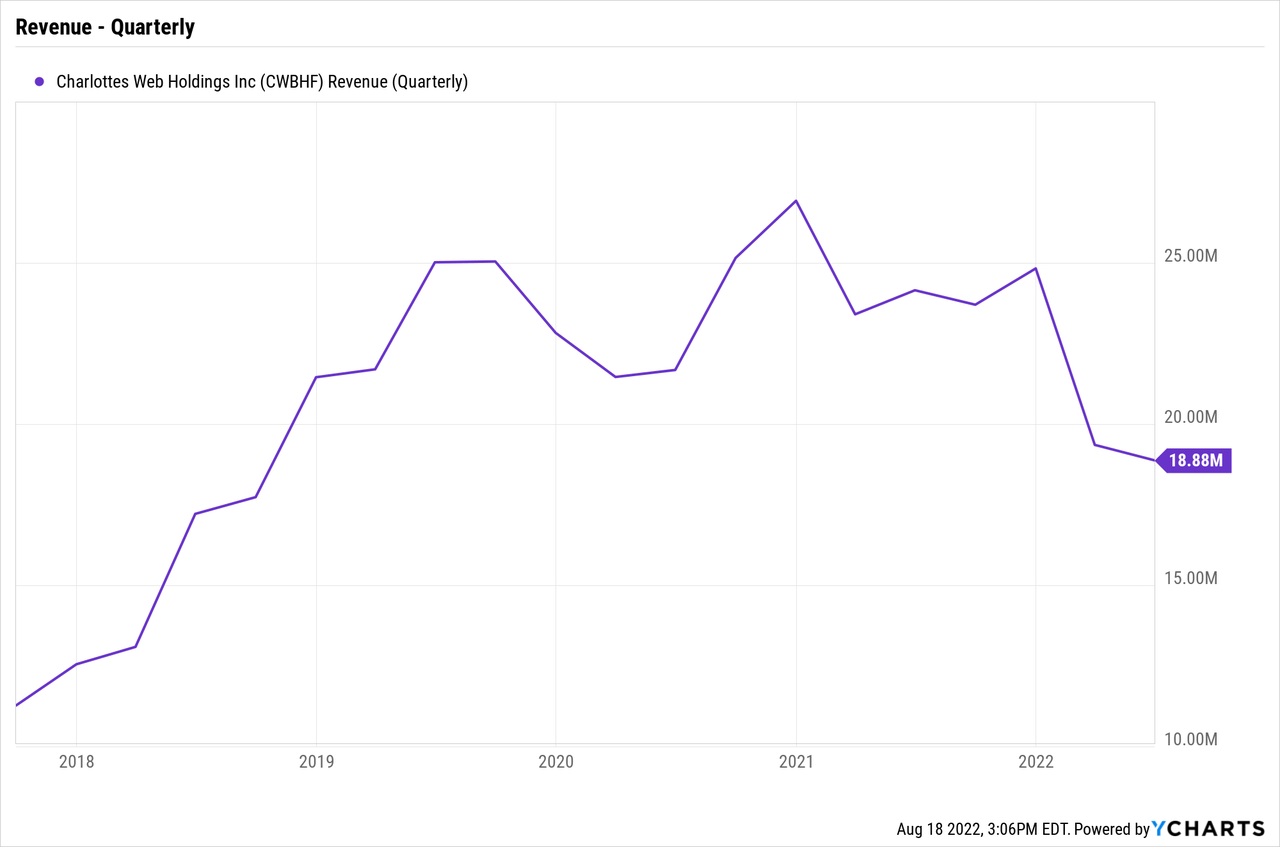

The full-spectrum hemp extract wellness company continues to see sales stall, and even deteriorate as it waits for the FDA to make a decision. For the second quarter of 2022, revenue was $18.9 million, down $5.3 million from the prior year. Excluding $0.9 million for inventory returns from a customer, sales were up slightly from 1Q22.

CWBHF Revenue (Quarterly) data by YCharts

CWBHF Revenue (Quarterly) data by YCharts

CWH was a leader in online CBD sales, so the company probably got a disproportionate boost from online sales during Covid. The current weakness is partly related to reduced e-commerce traffic as the US economy fully reopened over the past year. Also, B2B sales all but dried up to just $5.6 million, or $6.5 million if you exclude the inventory reserve.

The CBD specialist has done everything it seemed possible to mitigate sales declines, whether by entering international markets or new verticals. Either way, a lack of regulatory clarity has kept CBD sales stagnant since the Farm Bill was passed in 2019.

CWH has improved the company’s ability to achieve profitable operations with reduced revenues. The company cut SG&A expenses last year by 30%, and the recent reduction in July brings those expenses down to $70 million annually, or what amounts to $17.5 million quarterly.

For the second quarter of 2022, CWH reported an adjusted EBITDA loss of $0.54 million unadjusted for returned inventory and provisions. However, some of these expenses should be considered normal operations in a cannabis business.

CWH will need revenues approaching $30 million with gross margins above 60% to break even on an operating income basis. Naturally, the CBD leader will cut a substantial amount of cash flow losses just by surpassing $20 million in quarterly sales. CWH reports nearly $2 million in non-cash quarterly amortization costs along with an additional amount for stock-based compensation.

Promising opportunities

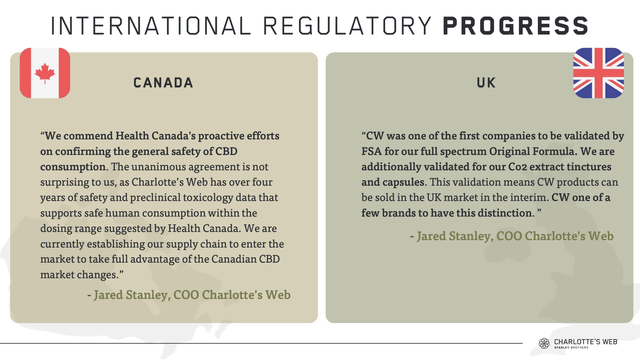

The reason to invest in CWH, or any CBD business, is the potential for regulatory changes to allow hemp in food products along with international and vertical expansion. International expansion remains promising on multiple fronts, with initial approvals in Canada and the UK. CWH has already entered Israel and has a distribution deal in Greater China through Energy Hemp Biotechnology.

Presentation CWH Q2’22

All of these countries add potential avenues for growth, but our view has always been skeptical that foreign companies will capture large portions of these markets. Of course, any revenue will be positive for a company that does not maintain current revenue levels.

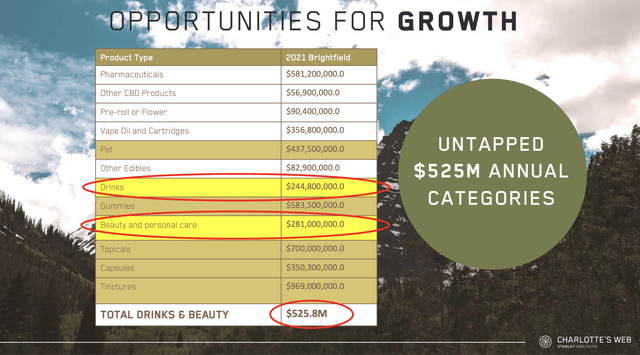

CWH has promising opportunities to enter the beverage and beauty segments, where there is a market opportunity worth more than $526 million. The company recently entered the pet segment and bought into other segments without these additional categories helping to improve sales as demand shifts and pricing pressures reduced sales in other verticals previously.

Presentation CWH Q2’22

The Brightfield Group forecasts US CBD sales will remain largely flat going forward without any FDA regulation. The research firm estimates that CBD sales will increase to $11 billion by 2027 with FDA regulations beginning in 2024.

CWH has about $17 million in cash on its balance sheet after some IRS refunds. The company must achieve positive cash flows to avoid material dilution by raising additional capital for the business.

The market cap is just a paltry $105 million now with 153 million diluted shares outstanding. The stock is trading at a minimal P/S multiple, but CWH is unlikely to rebound much until the CBD market is no longer regulated or an international location provides real material revenue growth.

Take away

The key for investors is that CWH is a tough stock to own, with the business story mostly stagnant until the FDA makes a regulatory decision. Investors aren’t likely to lose ownership of the stock here, but the best move might be to take a partial position with the intention of loading up when the business climate improves.